A First Principles guide to Data Availability: Part 3

A tactical view of the current DA market and directions for the future

Introduction

In Part 1 of this series we lay the foundation of what Data Availability is and what led to its emergence. In Part 2 we went more in detail on how the alternative non-Ethereum DA solutions are designed, their various components, and the implications of their economic models.

In this blog we’re going to shift tone a bit towards observing how the DA landscape is functioning today, and what some of the interesting paths are for DA in the future.

Contents

Part 1: Bottoms-up look at data availability and why it’s needed

Context on Ethereum’s rollup-centric roadmap

Deep dive: How rollups generate and utilize data on the Ethereum L1

Data availability for Optimistic rollups on Ethereum

Data availability for ZK rollups on Ethereum

Ethereum-native Data availability scaling

Part 2: (This article) Deep dive into current non-ETH data availability solutions and components

Alternative non-Ethereum Data Availability solutions

Deep dive on Fraud and Validity proofs

Data Availability vs. Data storage

Part 3 (This article): Where the future is headed for data availability

The current state of Data Availability

How DA is likely to evolve near-term

DA becoming commoditized

What happens as systems scale

Longer-term predictions and trends to watch

Current state of DA Affairs post-4844 and Celestia

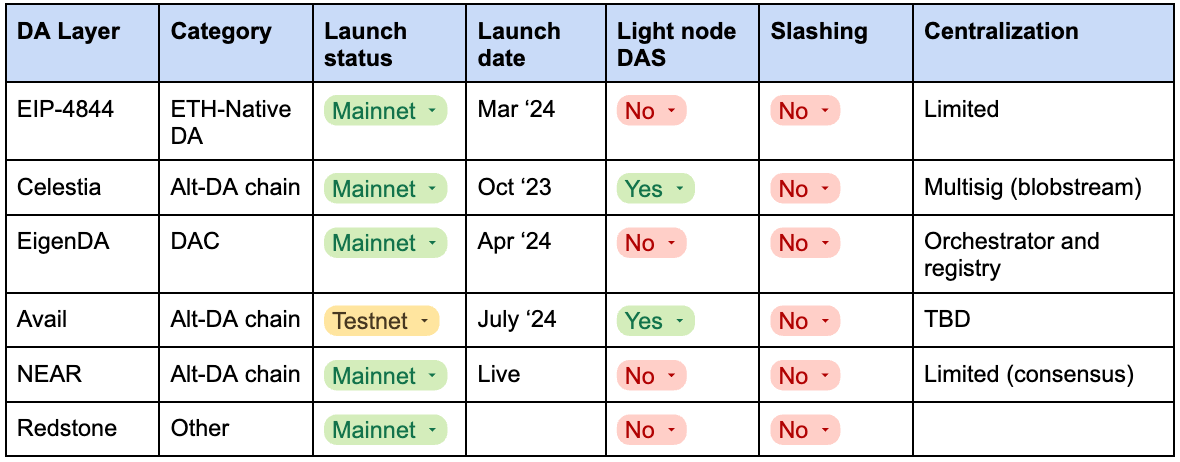

Since the first article, we’ve seen a series of launches in the DA space. Most notable are EIP-4844, extending Ethereum’s native DA Layer, Celestia the first true “alt-DA” chain, and EigenDA the first AVS. There has been a notable amount of hype and investment into these projects, with billions of dollars of valuation attached to them and their counterparts.

Taking a look back 6 months into late 2023, the web3 world was in a very different state:

BTC was $30k and ETH was $1800 - The latest bull run had not yet started

L2 scaling was in full flight, and Data Availability was one of the hottest topics at Istanbul

Ethereum daily transaction volumes were ~1M*

Today (June 2024) a few macro trends have emerged:

The market is oscillating around all time highs after a large bull run

The Halvening, BTC + ETH ETFs have been launched

Memecoins and AI Coins became the narrative of the bull run

Inscriptions have driven new demand for calldata and DA space

The first wave of L2 chains has matured

Ethereum daily transaction volumes are hovering around ~1.2M (20% increase)*

*Credit to Etherscan transaction dashboard

A large part of the DA thesis was an order of magnitude increase in transaction volume driving a need for significantly larger DA capacity. Testing this thesis is fairly simple - now that DA layers have launched, what % capacity has been utilized?

From the hype of late 2023 to now let's check in on the market and see:

How far along are these projects on their roadmap?

What has been the demand and adoption so far (overall metrics + major users)

How have security, cost and performance guarantees materialized?

Is the standalone DA model sustainable?

Hot takes 🌶️ - narratives playing out so far

As of the writing of this article (July 2024), a few narratives are playing out which we’ll dig deeper on:

DA projects are still early in their rollout and adoption phase, with significant technical milestones to come

4844 is preferred over Alt-DA for established legacy projects

DA prices have dropped over 95% relative to ETH Calldata

Capacity exceed demand significantly for DA after 4844 and Celestia launch

Fraud and Validity proofs are not being used across the board

1) DA layers are still early in rollout, with major technical hurdles to come

While we have seen the initial rollout of DA layers, starting with Celestia late in 2023 and more recently Ethereum’s Dencun upgrade in March 2024, we are still very early in the deployment of DA systems more broadly.

Trusted bridging for Alt-DA layers are needed to provide security for transactions on the L1, and currently stand as the big security risk in the DA infrastructure. Progress is being made, Celestia offering blobstream X (ZK-verified data bridge) as a proof of concept, however there is more distance to close since this limits security to the consensus on the Celestia network.

Proof layer is still underdeveloped and has not been enabled on any major chain in production. This development seems to be primarily driven by the large L2’s independently (e.g. OP Labs continues to be a leader here due to the work of ProtoLambda).

Data Availability Committees have been developed by several large projects as native DA solutions (e.g. Arbitrum Nitro, ZKPorter) and have seen good uptake among earlier stage projects or as a parallel DA option (e.g. zksync). The uptake of EigenDA will be an interesting narrative to follow, since it will be heavily marketed from an “Ethereum alignment” perspective and also be the first attempt at a DAC that is not ecosystem native.

2) EIP-4844 is the preferred DA layer by major existing projects

4844 “blobspace” is the preferred layer for large-scale L2’s so far, but this is not necessarily a surprise given it is natively integrated into Ethereum. Existing users do not require any integration / bridging to use EIP-4844 relative to alt-DA solutions like Celestia and Avail, who are still building out improvements (and confidence) on their solutions.

EigenDA will be an interesting addition - because it is perceived as “Ethereum-native’, the submission flow can be made to look native but the underlying system relies on external off-chain ‘Operators’ and the stake of the ETH network.

It’s important to distinguish between two types of usage:

Active usage - L2s / chains actively posting transactions to the DA layer as a primary store

Integrations - many RaaS providers / L2 toolkits (OP rollchains, orbit, etc.) have announced support or integration of various DA layers as a “vendor” but projects will still need to select

EIP-4844 blobspace is used by most of the high-visibility rollups in the web3 space. The top 5 L2s (Base, Arbitrum, Optimism, Taiko and Scroll) account for ~70% of the blob submissions. The usage of 4844 by these projects would imply that (unsurprisingly) existing projects utilizing Ethereum for DA are more likely to shift to 4844 than an alt-DA.

*Courtesy of the Galaxy Research team’s dune dashboard updated June 5th 2024

Celestia is seeing an increase in usage with ~20 rollups currently utilizing the network according to Celenium. Since mainnet launch in Oct ‘23 ( 6 months prior to 4844) there has not been large-scale movement of major chains from Ethereum to Celestia, although it’s believable that most Ethereum-based rollups were waiting for the launch of 4844 to assess prices. Therefore the majority of uptake has been from newer projects building directly on Celestia DA vs. migrating from Ethereum.

*Image courtesy of Celenium July 27th

Notably, several large projects have been actively utilizing Celestia and their volume has been consistent or increasing, e.g.:

Orderly: Liquidity provider

Lightlink: Gasless L2 network

Lyra: Options network

Manta Network: Modular ZK rollup

Hokum: gaming L3

EigenDA has launched on mainnet and is currently free to use for new participants. While they have not yet seen notable customer usage they have landed several distribution partnerships through integration with notable rollkit / service providers:

Avail has recently (July 23, ‘24) announced it’s mainnet launch, adding significantly more capacity to the DA supply side. Avail has integrations with 5 ecosystems so far (Polygon, Optimism, Arbitrum, zkSync and Starkware) - information is still sparse, but during testnet phase Avail claims to have processed enough transactions to support all L2 DA needs so far this year (200GB+)

An interesting statistic will be what % of the next generation of L2’s will utilize Ethereum vs. an alternative DA layer like Celestia, Avail or EigenDA.

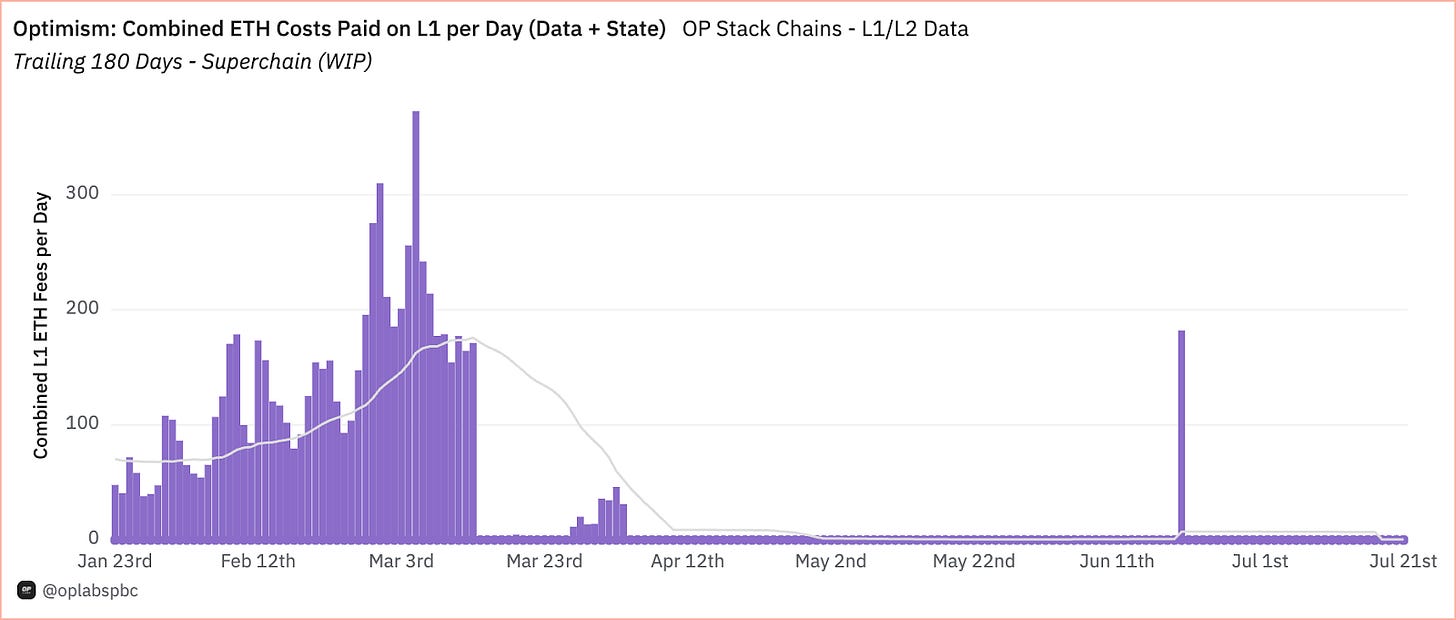

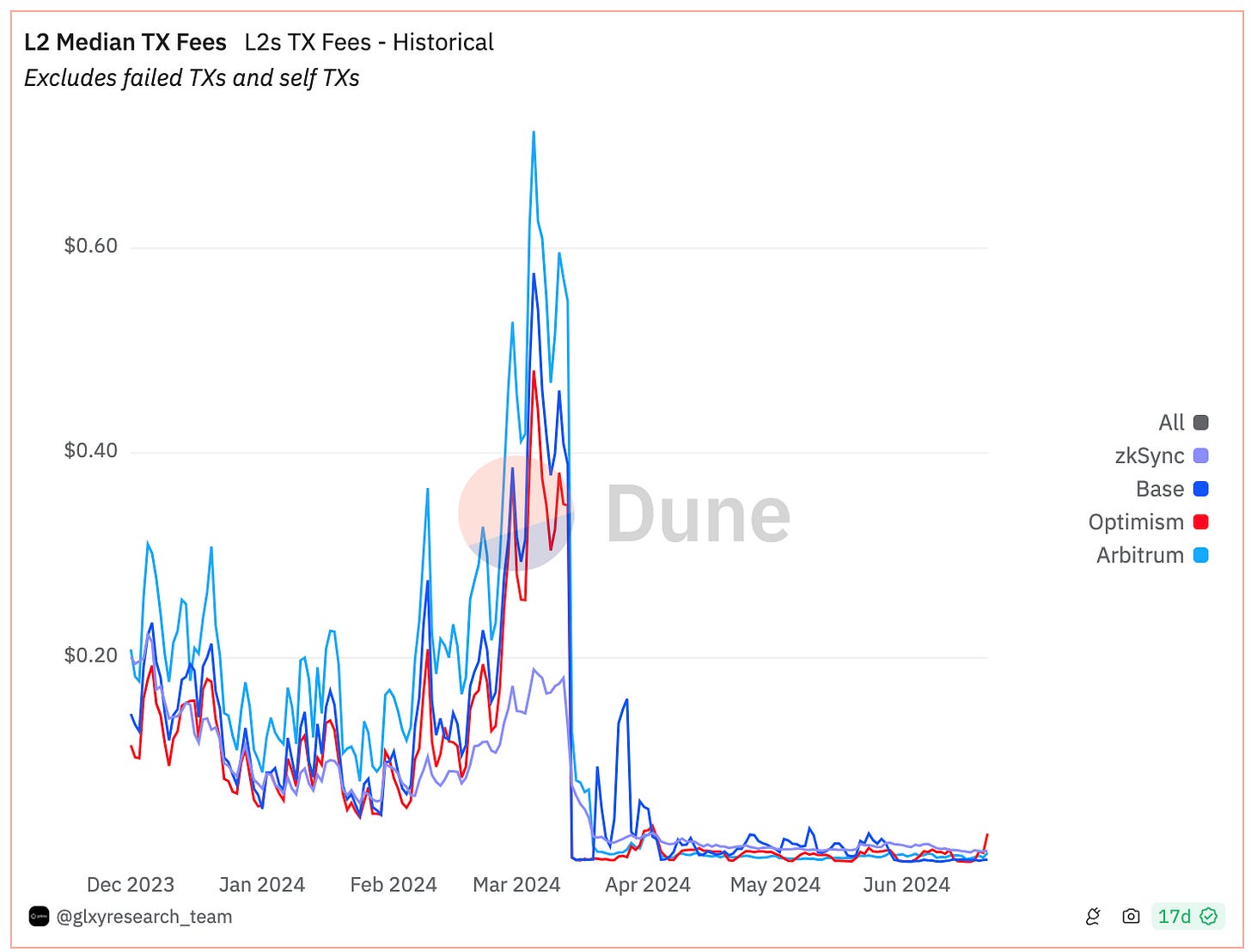

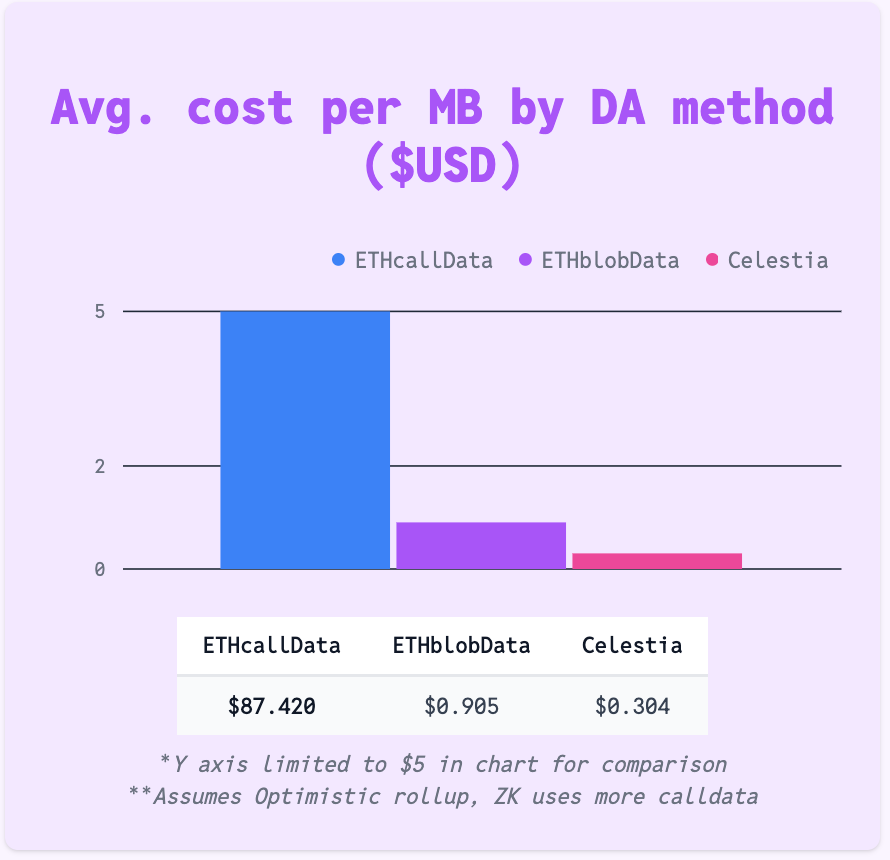

3) Prices have dropped over 95% on avg since launch of DA alternatives

So far, DA has succeeded in reducing the L2 cost on Ethereum considerably in practice. Average prices paid per MB of usage have dropped significantly outside of a few small spikes, on the order of 95%+ relative to early 2024 levels. Overall volatility has been down as well.

Source: Optimism foundation dashboard

Source: Galaxy Research

Comparing the average prices so far we see that, while 4844 is significantly cheaper than Ethereum Calldata, it still demands a premium over alt-DA alternatives like Celestia. Relative to a central database, DA cost is 10^4 times the equivalent per MB storage costs and we should see improvements on this front as more competition enters and the space is more robust.

Source: dacost.xyz

Celestia offers a cheaper alternative to EIP-4844 space by a significant margin however both are 90%+ improvements over status quo earlier this year which makes price elasticity hard to judge shorter term. EigenDA is currently offering free onboarding and Avail is very early, so expect several months of noise before true cost basis emerges. For more on dynamics of pricing see Part 2.

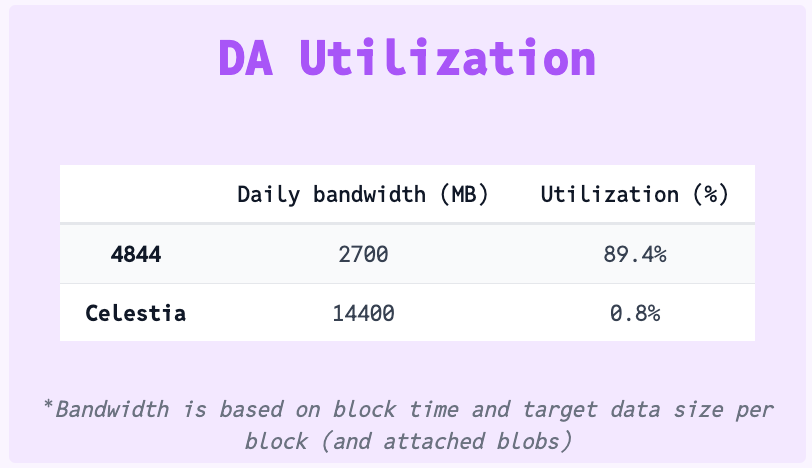

4) DA Capacity drastically exceeds demand so far for DA solutions

Data Availability is early in the adoption cycle, and so far it appears that available DA capacity has outstripped demand by a considerable margin outside 4844. Pricing of DA space is at an irrational spot right now due to the nascency of the field and the orders of magnitude improvements by new solutions. Despite being significantly lower cost, Celestia has not gained significant market share yet - this is likely because DA costs have dropped 95%+ for major chains relative to pre-4844 values, reducing the urgency to evaluate alternatives. Integrations also play a role, but with an estimated ~200GB of demand in the past 6 months (~1.1GB/day) against a daily capacity of 18GB across 4844 and Celestia alone, there will need to be step changes in activity to stress existing systems.

Source: dacost.xyz, live DA layer comparison

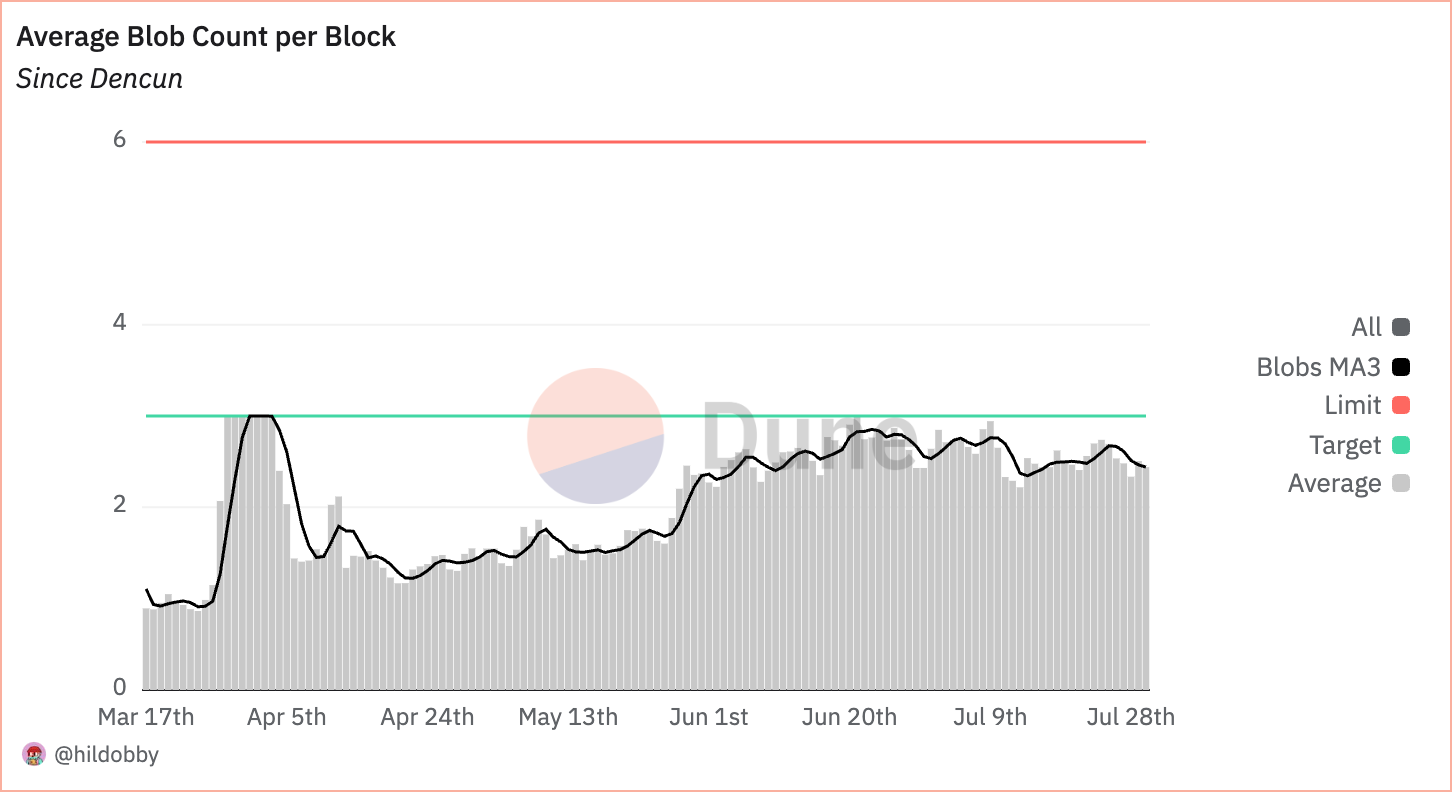

EIP-4844 has a current target of ~3 blobs per Block (~125KB each) but a potential capacity of 6 blobs for each block (published every 12s). This implies a target bandwidth of 2.7GB per day, which since launch (Mar. 13) has steadily increased towards target utilization.

Source: @hildobby dune dashboard

Transactions have been primarily base fees so far implying limited competition for blobspace, however priority fees have been increasing notably since mid-May which could be a trend towards increasing congestion.

Source: Galaxy Research

In the last 1-2 months there have been several spikes in demand for blobspace that drove prices higher than calldata, indicating that volatility will still be a problem. Paired with the increasing priority fees, it is likely that usage will continue to rise on blobspace and with it higher competition for limited bandwidth. In the roadmap is full Danksharding which will increase throughput by more than an order of magnitude, however it’s likely 1-2 years out.

**Notably, each of the 4844 blobs must be purchased entirely so there is some element of “underutilized” blobspace in 4844 that will be optimized to absorb 3-4x more data.

Celestia has a much larger bandwidth than 4844 but has not seen the same amount of traffic as of yet, likely due to the captive set of users that Ethereum had when 4844 launched. It has seen some growth and as of July 30th has transacted 42 GB of Data (source: Selenium), however it has filled only a fraction of capacity.

Celestia currently has 2MB blocks and a 12s blocktime, but can increase capacity to 8MB per block through governance (and some assumption of maintained security via a light node population). To saturate capacity on Celestia will require orders of magnitude growth in DA demand.

What is coming in the near term for DA

This is more speculative, but I’ll put forward a few ideas and questions for the next 6 months:

Market demand for DA becomes more sophisticated

As alt-DA layers mature, more projects will move to cheaper alternatives once security-cost tradeoffs are better understood. Naturally, segmentation of DA demand will happen as projects become sophisticated users and look to cost optimize. RaaS and service providers have started integrating multiple DA’s as they become commoditized, but expect new solutions to emerge that support DA switching.

New launches coming up will test demand fragmentation

EigenDA adoption will increase now that it’s live, and Avail has landed its DA solution on mainnet in the last week. Switching costs are still high, particularly due to the difficulty of fully integrating alternative DA solutions. Expect to see a minority of existing rollups switch but new ones to be more widely distributed.

Gaps in the tech stack need to be filled and change behaviors

Fraud proofs and validity proofs at scale are being solved, and will “close the loop” on DA usage to guarantee security. With an end-to-end security solution, the maturity of the DA layers will be tested with a more complex set of provers and data retrievals.

Light Nodes will require advances in research at the networking layer (e.g. making reader private / indistinguishable) to reach scalability hopes. Right now the presence of DAS does not seem to be a big buying choice for customers, but adoption is still early.

DA as a standalone model?

DA is currently functioning very well to reduce transaction costs for rollups, but can it be a standalone layer longer term or will it need to be enshrined in another product to be viable? It is VERY early to make any high confidence bets, but it is clear that orders of magnitude increase in demand are needed to start saturating supply in a meaningful way.

Right now new DA layers are launching tokens and subsidizing activity, but will need to demonstrate meaningful paid demand to become sustainable projects.

Celestia has been bootstrapping it’s network via inflation to strong traction from a partner and user perspective but it has not yet translated to sustainable demand - according to Celenium (as of July 27th), the fees paid to validators via block rewards were 251,000 TIA (~$1,400,000 USD) relative to 1,700 TIA ($9200 USD) in paid revenue.

EigenDA is currently free with 200 AVS Operators with a target capacity of 10MB/s (3-4x Celestia and 4844 combined), and other DAC solutions can quickly be spun up at low cost.

As mentioned in Part 2 - the economic model of DA does not seem sustainable in isolation, but can be promising as a component of a broader product (e.g. 4844 has Ethereum transactions, Celestia has rollups, EigenDA has EIGEN token). A subtler point will be to keep an eye on token vesting schedules as initial bootstrapping reaches more steady states, inflation continues to put pressure on token price, and core teams hit lockup periods. Downward pressure on token price is likely one of the biggest meta security risks for these networks.

Evolutions of the DA Layer

Trends

Users reaching maturity: Right now most projects have seen a significant decrease in DA costs which has taken the pressure off to optimize DA costs. However in the future as DA becomes more commoditized and its customers become more scaled / mature, cost optimization between layers will become important again.

DA Layer vertical expansion: current systems extend into broader value adds e.g. sequencing, settlement, proof aggregation. This could look like existing projects launching their own DA layers, DA-first layers expanding vertically into other functionality or a wave of partnerships. Alt-DA chains impose additional requirements on themselves by adding these layers but it may ultimately be required to fully capture transaction value.

Gaps and needs

Observability & monitoring: As the modular stack and DA layers become more widespread, data will need to be tracked from L2 submission through to final proof in order to ensure proper functioning. This will need to include broader monitoring of the underlying systems to ensure liveness of all components, sufficient economic activity, etc. There is a robust market in web2 around this functionality that will need to become a norm if we want more builders come to the space.

DA cost optimizations: As demand for DA increases, the volatility on Alt-DA chains driven by auction dynamics can be optimized by proper pricing forecasting. Fully utilizing blockspace on 4844 and understanding overages on Celestia can result in linear improvements as well.

Dynamic DA routing: Integrations for DA Layers are still needed to increase adoption - L2’s require specific implementation of smart contracts that must be properly implemented to guarantee full security of the solution. Over time once the integrations have been smoothed over, we could see L2’s submitting transactions to different DA layers based on need for security, cost, and throughput.

DA Indexing: indexing DA layers will be required to efficiently retrieve the data needed as part of the proof process. If Dynamic DA routing is implemented and data is sent across multiple layers, we could see a need for aggregating a full view of data commitments, proofs, and finalized transactions across multiple systems. For this to work effectively we need highly robust retrieval and tracking.